Are We Experiencing A Housing Bubble?

Is It A Bad Time To Buy A Home Or The BEST Time?

I hear it almost every day; people are afraid to purchase a home because they believe we’re in another housing bubble that could burst at any moment. I wish I had a crystal ball and knew what the next decade was going to bring to the real estate market but the truth is, there is no for sure answer. Even some of the top analysts disagree on the subject. What we can do is take data from today’s housing market and compare it to the real estate downturn 10 years ago and see that things look vastly different this time around.

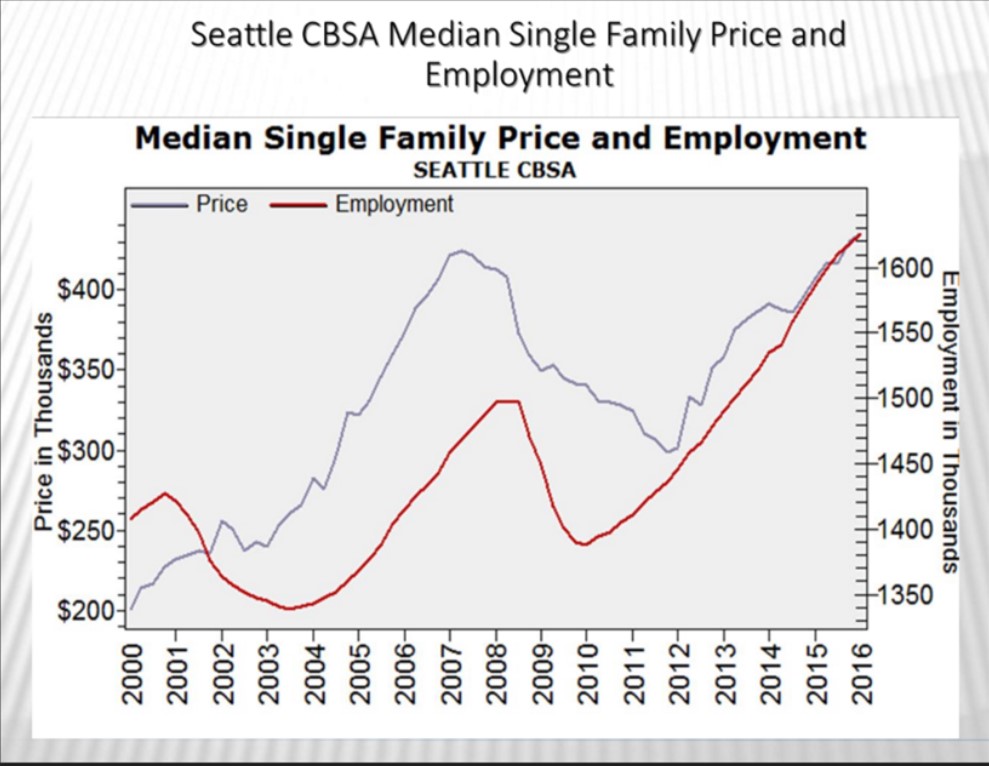

The following graph shows housing prices compared to employment trends. As you can see, in 2006 there was a vast difference between housing prices and employment. Based on that information alone, it is clear that people were purchasing homes at an unstable time. Due to low employment numbers, it was only a matter of time before the bottom fell out.

What is so exciting to see is that as we enter 2016, housing prices and employment have synced up. This means that the prices we are seeing throughout the region are pushing upwards because families are in a better position to purchase. Take this into account along with record low inventory, an influx of people relocating to the region and our strong local economy supported by large employers like Google, Amazon and Microsoft, we’re simply seeing prices line up with their actual increased value.

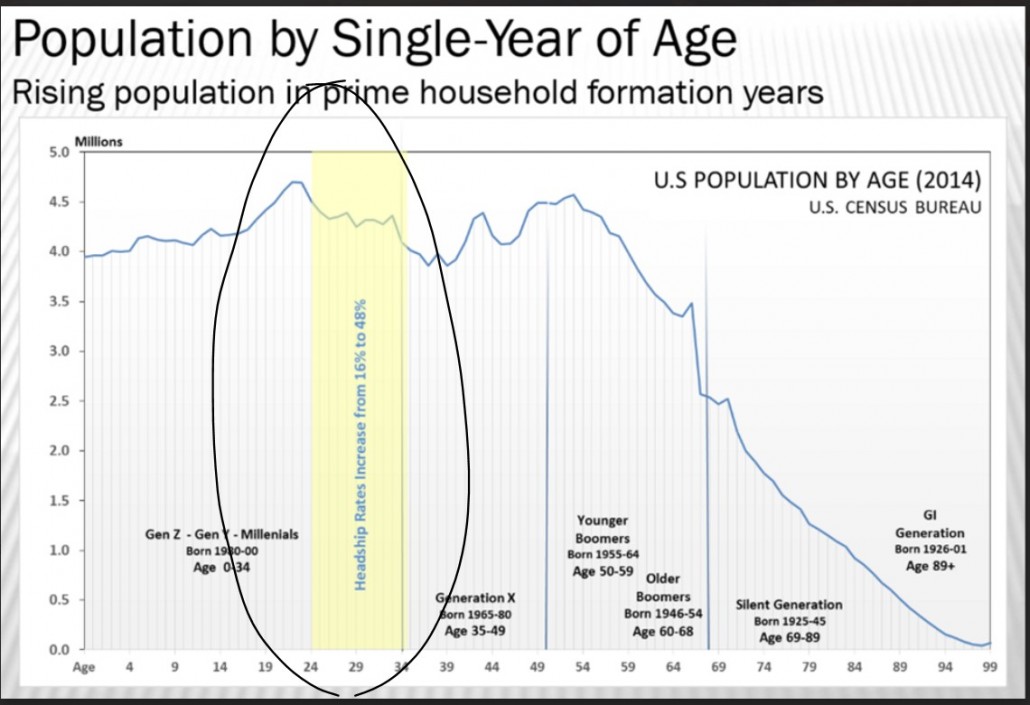

In addition to the influx of people relocating to the pacific northwest, we’re seeing a very large increase of young people entering the market, looking to purchase their first home.

For many, right now is an amazing time to purchase. Interest rates are low, lending has opened up with programs to help home buyers get into a property with zero down and in many regions, it is now cheaper to buy than rent. While we cannot predict with certainty what will happen over the next decade, purchasing a home should always be a decision made after looking at your own personal financial situation.

-Natasha King

Leave a Reply

Want to join the discussion?Feel free to contribute!